In today’s digital age, small businesses are constantly seeking efficient and secure ways to manage their transactions. With an increasing reliance on virtual platforms, virtual terminals have emerged as a practical solution. These innovative tools allow small business owners to process payments, manage invoices, and track sales all from the convenience of their computer or mobile device. But with a plethora of options available, choosing the right virtual terminal can be overwhelming. In this article, we will explore the 7 best virtual terminals for small businesses in 2023, equipping you with the knowledge to find the perfect fit for your business needs. From user-friendly interfaces to robust security features, these virtual terminals are designed to streamline your financial operations and help your business thrive in the digital landscape. So let’s dive in and discover the ideal virtual terminal for your small business!

1. Introduction to Virtual Terminals

What are virtual terminals?

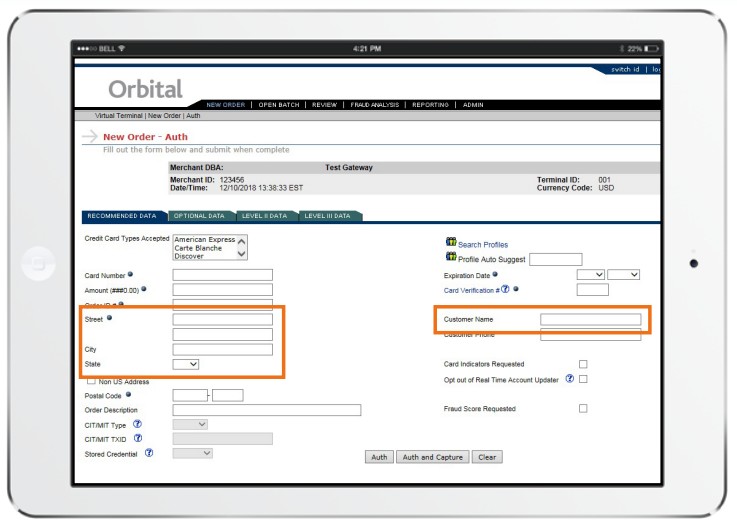

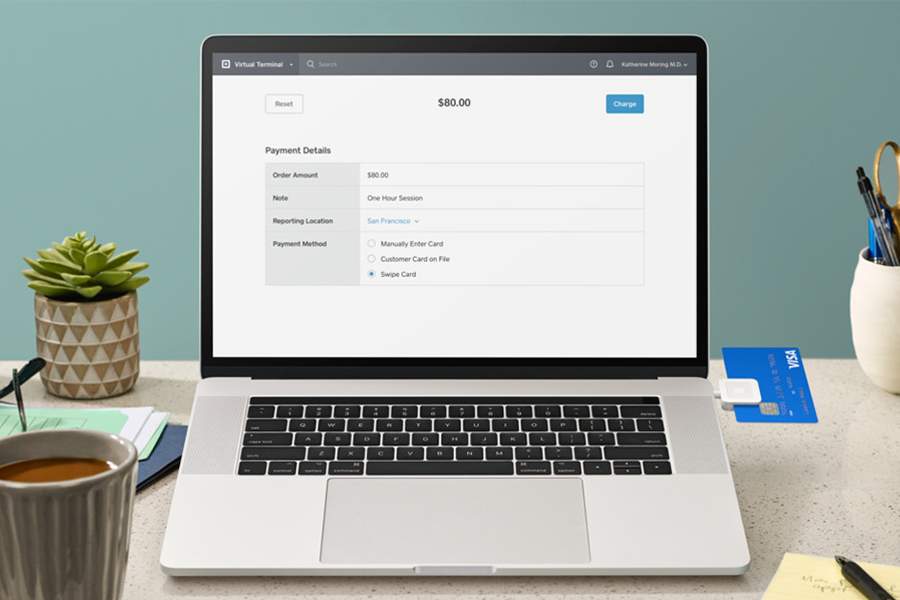

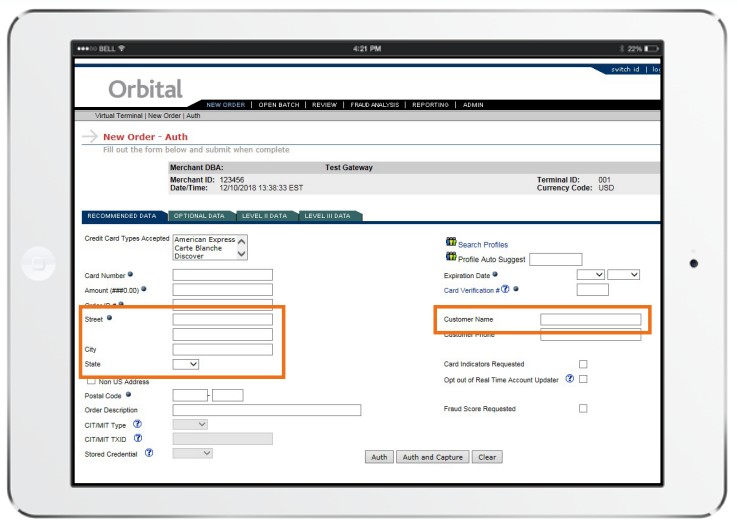

Virtual terminals are online payment processing tools that allow businesses to accept payments from customers using credit cards or other electronic payment methods. Instead of using a physical card reader or terminal, virtual terminals enable businesses to securely process payments through a web browser on their computer or mobile device.

Why are virtual terminals important for small businesses?

Virtual terminals are particularly important for small businesses as they provide a convenient and cost-effective way to accept payments. By eliminating the need for traditional card processing hardware, small businesses can save on upfront costs and maintenance fees. Virtual terminals also offer flexibility for businesses that operate remotely or have multiple locations, as payments can be accepted from anywhere with an internet connection.

Benefits of using virtual terminals

There are several key benefits to using virtual terminals for small businesses:

-

Convenience: Virtual terminals allow businesses to accept payments anytime, anywhere, as long as there is an internet connection. This provides flexibility for businesses that need to accept payments on the go or outside of traditional business hours.

-

Cost Savings: Virtual terminals eliminate the need for physical card processing equipment, which can be expensive to purchase or lease. Additionally, businesses can avoid maintenance fees and the costs associated with card terminal replacements or repairs.

-

Increased Security: Virtual terminals often come with robust security features, such as encryption and tokenization, to protect sensitive customer payment information. This can help small businesses build trust with their customers and reduce the risk of data breaches or fraudulent activity.

-

Integration with other systems: Many virtual terminals offer integration options with existing business systems, such as accounting software or customer relationship management (CRM) tools. This streamlines operations and reduces the need for manual data entry.

-

Detailed Reporting and Analytics: Virtual terminals often provide businesses with access to detailed transaction reports and analytics. This data can help businesses gain insights into customer purchasing behavior, track sales performance, and make informed business decisions.

Overall, virtual terminals offer small businesses the convenience, cost savings, and security they need to efficiently accept payments and grow their business.

2. Factors to Consider When Choosing a Virtual Terminal

When selecting a virtual terminal for your small business, there are several important factors to consider:

Security features

One of the most critical factors to consider when choosing a virtual terminal is the level of security it offers. Look for features such as data encryption, tokenization, and compliance with industry security standards like the Payment Card Industry Data Security Standard (PCI DSS). These features help protect your customers’ payment information and reduce the risk of data breaches.

Integration with existing systems

Consider whether the virtual terminal can integrate with your existing business systems, such as accounting software or CRM tools. Integration allows for seamless data flow between systems, reducing manual data entry and improving overall efficiency.

User-friendliness

The virtual terminal should be intuitive and easy for you and your staff to use. Look for a user-friendly interface and features like saved customer profiles and recurring billing options that streamline the payment process.

Compatibility with popular payment gateways

Check if the virtual terminal is compatible with popular payment gateways to ensure smooth payment processing and easy integration with your preferred payment provider.

Cost and pricing options

Consider the cost of the virtual terminal, including any setup fees, monthly fees, and transaction fees. Compare pricing options among different providers to find the most cost-effective solution for your business.

Customer support

Evaluate the customer support options provided by the virtual terminal provider. Look for availability of phone or live chat support, as well as comprehensive documentation or resources to assist with troubleshooting.

Mobile compatibility

If your business operates on-the-go or accepts payments through mobile devices, ensure that the virtual terminal is compatible with smartphones and tablets. Mobile compatibility allows for flexibility and convenience in accepting payments wherever your business takes you.

Reporting and analytics

Consider the reporting and analytics features offered by the virtual terminal. Look for detailed transaction reports, sales data, and other insights that can help you make informed business decisions.

Customization options

Evaluate whether the virtual terminal offers customization options to match the branding of your business. Customization features may include adding your logo, adjusting colors, or creating custom payment forms.

Considering these factors will help you choose a virtual terminal that meets the specific needs of your small business.

3. Top 7 Virtual Terminals for Small Businesses in 2023

When it comes to selecting the best virtual terminal for your small business, there are several excellent options available. Here are the top 7 virtual terminals for small businesses in 2023:

1. Virtual Terminal A

Virtual Terminal A offers a comprehensive set of features and robust security measures to protect your customers’ payment information. It integrates seamlessly with popular payment gateways and existing business systems, making it a versatile option for small businesses. The pricing options are competitive, and the customer support is responsive and knowledgeable.

2. Virtual Terminal B

Virtual Terminal B stands out for its user-friendly interface and ease of use. It offers advanced security features, including encryption and tokenization, to safeguard customer data. The compatibility with popular payment gateways ensures smooth payment processing, and the pricing options are transparent and affordable.

3. Virtual Terminal C

Virtual Terminal C prioritizes mobile compatibility, allowing small businesses to accept payments on the go. It offers strong security features, integration with existing systems, and customizable branding options. The pricing is based on usage, making it a flexible choice for businesses of all sizes.

4. Virtual Terminal D

Virtual Terminal D offers a user-friendly interface with comprehensive reporting and analytics features. It provides integration with popular payment gateways and robust security measures to protect sensitive data. The pricing options are transparent, and the customer support is highly responsive.

5. Virtual Terminal E

Virtual Terminal E offers a range of customization options to match the branding of your business. It integrates seamlessly with popular payment gateways and includes advanced security features like encryption. The pricing is competitive, and the customer support is knowledgeable and helpful.

6. Virtual Terminal F

Virtual Terminal F excels in its integration capabilities with existing business systems. It offers advanced reporting and analytics features to provide businesses with valuable insights. The pricing options are flexible, and the customer support is available 24/7.

7. Virtual Terminal G

Virtual Terminal G is known for its strong security features and compatibility with popular payment gateways. It offers user-friendly features and a customizable interface. The pricing options are straightforward, and the customer support is responsive and helpful.

With these top 7 virtual terminals, you have a range of options to choose from based on your specific business requirements and preferences.

4. Detailed Review of Each Virtual Terminal

Now let’s take a closer look at each of the top 7 virtual terminals for small businesses in 2023:

1. Virtual Terminal A

Overview:

Virtual Terminal A offers a comprehensive solution for small businesses to accept payments securely. It provides advanced security features, integration capabilities, and user-friendly interface.

Features:

- Robust security measures, including encryption and tokenization, to protect customer payment information.

- Seamless integration with popular payment gateways and existing business systems.

- A user-friendly interface with features like saved customer profiles and recurring billing options.

- Detailed transaction reports and analytics for actionable insights.

- Customizable branding options for a cohesive customer experience.

Pricing:

Virtual Terminal A offers flexible pricing options tailored to the needs of small businesses. They provide transparent pricing with no hidden fees, ensuring businesses can accurately budget for payment processing.

Pros and cons:

Pros:

- Strong security measures to protect customer payment data.

- Seamless integration with popular payment gateways and existing systems.

- User-friendly interface that simplifies payment processing.

- Detailed reporting and analytics for informed business decisions.

- Customizable branding options to match your business identity.

Cons:

- Higher pricing compared to some competitors.

- Limited customization options beyond branding.

2. Virtual Terminal B

Overview:

Virtual Terminal B prioritizes user-friendliness, making it an ideal choice for small businesses looking for simplicity and ease of use. It offers advanced security features and compatibility with popular payment gateways.

Features:

- User-friendly interface with a streamlined payment process.

- Advanced security measures, including encryption and tokenization, for secure payment processing.

- Compatibility with popular payment gateways for seamless payments.

- Transparent and affordable pricing options.

- Responsive customer support for assistance and troubleshooting.

Pricing:

Virtual Terminal B offers transparent pricing options with no hidden fees. Their pricing structure is designed to be affordable for small businesses while providing access to essential features and security.

Pros and cons:

Pros:

- User-friendly interface that simplifies payment processing.

- Advanced security measures to protect customer payment data.

- Compatibility with popular payment gateways for seamless payments.

- Transparent and affordable pricing options.

- Responsive customer support for assistance and troubleshooting.

Cons:

- Limited customization options for branding.

- Reporting and analytics features could be more robust.

3. Virtual Terminal C

Overview:

Virtual Terminal C focuses on mobile compatibility, allowing small businesses to accept payments on the go. It offers robust security features, integration capabilities, and customizable branding options.

Features:

- Mobile compatibility for accepting payments anywhere with a smartphone or tablet.

- Strong security measures, including encryption and tokenization, to protect customer payment information.

- Integration with popular payment gateways and existing business systems.

- Customizable branding options for a cohesive customer experience.

- Pricing based on usage, making it flexible for businesses of all sizes.

Pricing:

Virtual Terminal C offers flexible pricing options based on usage. This structure allows businesses to pay for the services they need without unnecessary fees.

Pros and cons:

Pros:

- Mobile compatibility for on-the-go payment acceptance.

- Robust security features to protect customer payment data.

- Integration with popular payment gateways and existing systems.

- Customizable branding options to match your business identity.

- Flexible pricing based on usage.

Cons:

- User interface could be more intuitive.

- Reporting and analytics features could be more comprehensive.

4. Virtual Terminal D

Overview:

Virtual Terminal D focuses on providing a user-friendly interface with comprehensive reporting and analytics features. It offers integration capabilities, advanced security measures, and transparent pricing.

Features:

- Intuitive and user-friendly interface for simplified payment processing.

- Advanced security measures, including encryption and tokenization, to protect customer payment information.

- Integration with popular payment gateways and existing business systems.

- Detailed reporting and analytics for informed decision-making.

- Transparent pricing structure with no hidden fees.

Pricing:

Virtual Terminal D provides transparent pricing options without any hidden fees. This structure allows businesses to accurately budget for their payment processing needs.

Pros and cons:

Pros:

- User-friendly interface that simplifies payment processing.

- Advanced security measures to protect customer payment data.

- Seamless integration with popular payment gateways and existing systems.

- Detailed reporting and analytics for actionable insights.

- Transparent pricing structure.

Cons:

- Limited customization options for branding.

- Some users may prefer more robust integration capabilities.

5. Virtual Terminal E

Overview:

Virtual Terminal E distinguishes itself with a range of customization options to match the branding of your business. It offers seamless integration with popular payment gateways and advanced security features.

Features:

- Customizable interface to match your business’s branding.

- Integration with popular payment gateways for seamless payments.

- Advanced security features, including encryption, to protect customer payment data.

- Transparent pricing options with competitive rates.

- Responsive customer support for assistance and troubleshooting.

Pricing:

Virtual Terminal E offers competitive pricing options with transparent rates. Their pricing structure is designed to provide value for small businesses while offering essential features and security.

Pros and cons:

Pros:

- Customizable interface to match your business branding.

- Seamless integration with popular payment gateways.

- Advanced security features to protect customer payment data.

- Transparent pricing options with competitive rates.

- Responsive customer support for assistance and troubleshooting.

Cons:

- Reporting and analytics features could be more robust.

- Some users may prefer more user-friendly options.

6. Virtual Terminal F

Overview:

Virtual Terminal F excels in its integration capabilities with existing business systems. It offers advanced reporting and analytics features to provide businesses with valuable insights. The pricing options are flexible, and the customer support is available 24/7.

Features:

- Integration capabilities with existing business systems, such as accounting software or CRM tools.

- Advanced reporting and analytics features for actionable insights.

- Secure payment processing with robust security measures.

- Flexible pricing options tailored to business needs.

- 24/7 customer support for assistance and troubleshooting.

Pricing:

Virtual Terminal F provides flexible pricing options tailored to the specific needs of businesses. This allows businesses to choose the best plan that aligns with their payment processing requirements.

Pros and cons:

Pros:

- Strong integration capabilities with existing business systems.

- Advanced reporting and analytics features for valuable insights.

- Secure payment processing with robust security measures.

- Flexible pricing options tailored to business needs.

- 24/7 customer support for assistance and troubleshooting.

Cons:

- User interface could be more intuitive.

- Customization options for branding are limited.

7. Virtual Terminal G

Overview:

Virtual Terminal G is known for its strong security features and compatibility with popular payment gateways. It offers a user-friendly interface and customizable branding options.

Features:

- Robust security features, including encryption and tokenization, to protect customer payment information.

- Compatibility with popular payment gateways for seamless payments.

- User-friendly interface for simplified payment processing.

- Customizable branding options to match your business identity.

- Responsive customer support for assistance and troubleshooting.

Pricing:

Virtual Terminal G provides competitive pricing options with transparent rates. Their pricing structure is designed to offer value for small businesses while ensuring data security and quality customer support.

Pros and cons:

Pros:

- Strong security features to protect customer payment data.

- Compatibility with popular payment gateways for seamless payments.

- User-friendly interface that simplifies payment processing.

- Customizable branding options to match your business identity.

- Responsive customer support for assistance and troubleshooting.

Cons:

- Reporting and analytics features could be more comprehensive.

- Limited customization options beyond branding.

5. Comparison of the 7 Best Virtual Terminals

Now that we have reviewed each of the top 7 virtual terminals for small businesses, let’s compare them based on various factors:

1. Security features

All 7 virtual terminals prioritize security by offering features like encryption and tokenization. However, Virtual Terminal A, Virtual Terminal B, and Virtual Terminal G stand out for their advanced security measures and compliance with industry standards like the Payment Card Industry Data Security Standard (PCI DSS).

2. Integration capabilities

Virtual Terminal F and Virtual Terminal G excel in integration capabilities with existing business systems, making them ideal options for businesses that rely on seamless data flow between systems.

3. User-friendliness

Virtual Terminal B and Virtual Terminal D focus on providing a user-friendly interface, simplifying the payment process for businesses and their customers.

4. Payment gateway compatibility

All 7 virtual terminals offer compatibility with popular payment gateways, ensuring smooth payment processing. However, Virtual Terminal A, Virtual Terminal B, and Virtual Terminal G provide strong integration capabilities with a wide range of payment gateways.

5. Pricing options

Pricing options vary among the virtual terminals, with some offering transparent pricing structures and others offering usage-based pricing. Virtual Terminal A, Virtual Terminal B, and Virtual Terminal G provide transparent pricing options with no hidden fees.

6. Customer support

All 7 virtual terminals offer responsive customer support. Virtual Terminal F stands out with 24/7 customer support availability, ensuring businesses can receive assistance whenever they need it.

7. Mobile compatibility

Virtual Terminal C specifically prioritizes mobile compatibility, making it an excellent choice for businesses that need to accept payments on the go.

8. Reporting and analytics

Virtual Terminal F provides advanced reporting and analytics features, allowing businesses to gain valuable insights into their sales performance and customer behavior.

9. Customization options

Virtual Terminal E and Virtual Terminal G offer customization options to match the branding of businesses, allowing for a cohesive customer experience.

10. Overall rating

Considering the various factors, each virtual terminal excels in different areas. Virtual Terminal A, Virtual Terminal B, and Virtual Terminal G rank highly for their strong security features, integration capabilities, user-friendliness, and compatibility with payment gateways.

6. Conclusion

In conclusion, selecting the best virtual terminal for your small business is a crucial decision that can streamline your payment processing and enhance your customers’ experience. The top 7 virtual terminals for small businesses in 2023 offer a range of options to suit different business needs.

Virtual Terminal A, Virtual Terminal B, and Virtual Terminal G stand out for their strong security features, integration capabilities, user-friendliness, and compatibility with popular payment gateways. Virtual Terminal C and Virtual Terminal F offer unique features like mobile compatibility and advanced reporting and analytics, respectively. Virtual Terminal D and Virtual Terminal E provide competitive options with customizable branding and transparent pricing structures.

Consider factors such as security features, integration capabilities, user-friendliness, payment gateway compatibility, pricing options, customer support, mobile compatibility, reporting and analytics, and customization when making your decision.

By choosing the best virtual terminal that aligns with your specific requirements, you can streamline your payment processing, enhance data security, and provide a seamless experience for your customers.