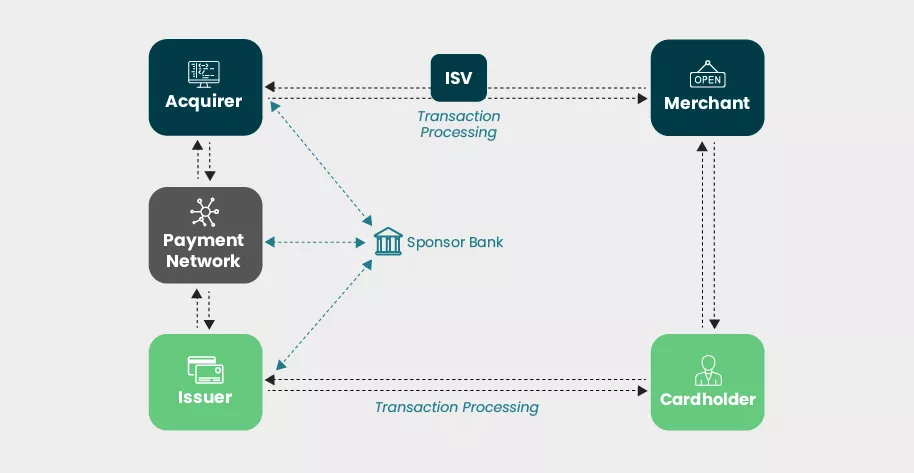

In the world of business, staying ahead of the competition is crucial for growth and success. One key aspect of running a successful business is having effective payment integration systems in place. However, understanding ISV payment integrations can be a complex and confusing task. That’s where we come in. In this article, we will take the confusion out of ISV payment integrations and provide you with the knowledge you need to drive your business’s growth. Whether you’re a business owner in Detroit, Michigan or anywhere else, understanding ISV payment integrations is essential for maximizing your business’s potential.

The Importance of ISV Payment Integrations

In today’s fast-paced and digitally-driven business landscape, integrating payment solutions into your software is crucial for success. ISV payment integrations, or Independent Software Vendor payment integrations, offer a seamless and efficient way for businesses to accept and process payments. This comprehensive article will delve into the importance of ISV payment integrations, the types available, considerations for selecting the right integration, steps to implement them, common challenges faced, benefits for business growth, considerations for choosing integration partners, case studies of successful integrations, and future trends and innovations in this field.

Increasing Efficiency and Productivity

One of the primary advantages of incorporating ISV payment integrations into your business is the substantial increase in efficiency and productivity. By seamlessly integrating payment gateways, point of sale (POS) systems, accounting software, and e-commerce platforms into your existing software, you eliminate the need for manual data entry and significantly reduce the chances of errors. This streamlined process allows your business to automate payment processes, saving time and resources, and allowing you to focus on other core areas of your business.

Enhancing Customer Experience

Another essential aspect of ISV payment integrations is the significant enhancement they bring to the overall customer experience. Integrating secure and user-friendly payment solutions creates a seamless purchasing journey for your customers. With the ability to provide multiple payment options and hassle-free transactions, you can cater to the diverse preferences of your customers, improving their satisfaction and loyalty. Additionally, features like real-time reporting and accurate inventory management contribute to a more personalized and efficient customer experience.

Streamlining Business Operations

ISV payment integrations play a vital role in streamlining your overall business operations. By integrating various payment tools and software, you can consolidate and centralize your financial management processes. This centralization allows for easy access to transaction information, simplifies the reconciliation process, and improves the accuracy of financial reports. Moreover, streamlined business operations lead to better decision-making capabilities, as you have real-time insights into your financial data.

Types of ISV Payment Integrations

Payment Gateways

Payment gateways are an essential component of ISV payment integrations. These gateways serve as the bridge between your software and your customers’ payment information. They securely transmit this information for authorization, ensuring the safety and privacy of sensitive data. Well-known payment gateways include PayPal, Stripe, and Authorize.Net. Depending on your business needs, you can integrate a preferred payment gateway into your software, allowing for seamless and secure electronic transactions.

Point of Sale (POS) Systems

Integrating POS systems into your software enables you to accept payments in physical retail locations. These systems are specifically designed for in-person transactions, allowing your business to process credit card transactions, manage inventory, and generate detailed sales reports. Popular POS systems include Square, Clover, and Lightspeed. By integrating a POS system into your software, you can effortlessly manage your sales operations and provide a smooth checkout experience for your customers.

Accounting Software

Integrating accounting software into your business software offers numerous benefits in terms of financial management. Accounting software allows you to track and manage your revenue, expenses, invoices, and other financial transactions. Popular accounting software options include QuickBooks, Xero, and FreshBooks. By integrating accounting software, you can automate bookkeeping tasks, generate accurate financial reports, and streamline your overall financial management processes.

E-commerce Platforms

For businesses operating in the online realm, integrating e-commerce platforms into their software is crucial. E-commerce platforms facilitate online transactions, allowing customers to purchase products or services directly from your website or online store. Well-known e-commerce platforms include Shopify, WooCommerce, and Magento. By integrating an e-commerce platform, you can create a user-friendly online shopping experience, manage inventory efficiently, and process payments securely.

Considerations for Selecting ISV Payment Integrations

When selecting ISV payment integrations for your business, several key considerations come into play. These considerations ensure that the chosen integration is compatible, secure, scalable, and cost-effective.

Compatibility with Existing Systems

One crucial consideration when selecting ISV payment integrations is the compatibility with your existing systems. It is essential to choose an integration that seamlessly works with your software, avoiding any conflicts or disruptions in your business operations. Assessing your current infrastructure and evaluating compatibility will help you choose the right integration that fits your unique business needs.

Security and Compliance

Security is of paramount importance when it comes to processing payments. Any chosen ISV payment integration must comply with industry standards and regulations, such as PCI DSS (Payment Card Industry Data Security Standard). Ensure that the integration provides robust security measures, encrypts sensitive data, and follows strict authentication protocols. Choosing a secure integration protects both your business and your customers’ data from potential breaches or fraud.

Scalability and Flexibility

As your business grows, it is crucial to select ISV payment integrations that are scalable and flexible. Consider the future demands of your business and choose an integration that can accommodate increased transaction volumes and additional features. Scalable integrations allow your business to grow without any limitations, while flexible integrations can adapt to evolving market trends and customer preferences.

Cost and Pricing Structure

The cost and pricing structure of ISV payment integrations are significant considerations for any business. It is essential to evaluate the financial implications associated with the integration, such as setup fees, monthly charges, transaction fees, and any additional costs for customization or support. Balancing the upfront and ongoing costs with the value and benefits the integration provides is crucial in determining the most cost-effective solution for your business.

Steps to Implement ISV Payment Integrations

Implementing ISV payment integrations requires careful planning and execution to ensure a successful integration that adds value to your business operations.

Assessing Business Needs and Goals

The first step in implementing ISV payment integrations is to assess your business needs and goals. Determine what payment functionalities are essential for your business and how the integration will benefit your overall operations. Consider factors such as the volume and type of transactions, target customer base, and the need for specific features like real-time reporting or inventory management.

Researching Available Options

Once you have a clear understanding of your business needs, conduct thorough research to identify the available ISV payment integration options. Compare and contrast the features, functionalities, and pricing structures of different integrations. Look for integrations that align with your business requirements and have positive reviews and ratings from other users.

Evaluating Integration Features

Narrow down your options and evaluate the features and capabilities of each integration in detail. Consider factors such as ease of use, customization options, reporting capabilities, compatibility with other systems, and customer support. Take advantage of free trials or demo versions to test the integrations first-hand and assess how they meet your specific business needs.

Testing and Implementation

Once you have selected the integration that best suits your business requirements, it is time to test and implement it. Create a detailed implementation plan, clearly outlining the steps involved, assigning responsibilities, and setting a timeline. Before going live, thoroughly test the integration for any potential issues or glitches. Ensure that all stakeholders are trained and familiar with the new integration, and provide ongoing technical support as needed.

Common Challenges and Solutions in ISV Payment Integrations

While implementing ISV payment integrations can greatly benefit your business, certain challenges may arise during the process. It is essential to anticipate these challenges and have strategies in place to overcome them.

Integration Complexity

Integration complexity can be a significant challenge in ISV payment integrations, particularly if your existing software has highly customized or intricate systems. The solution lies in thorough planning and partnering with a reputable integration provider. Ensure that the chosen integration has a user-friendly interface, clear documentation, and robust technical support to assist you throughout the integration process.

Data Synchronization Issues

Synchronizing data between your software and the payment integration system is crucial for accurate reporting and a seamless customer experience. However, data synchronization issues can occur, leading to discrepancies or delays. Regularly monitor and validate your data to identify and address any synchronization issues promptly. Additionally, work closely with your integration provider to troubleshoot any compatibility or data mapping issues that may arise.

Payment Processing Delays

Payment processing delays can impact the overall efficiency and customer experience of your business. These delays may result from issues such as slow network connections, network outages, or technical glitches. To mitigate payment processing delays, implement redundancy measures, such as multiple payment gateways or backup systems. Regularly monitor your payment processes and maintain open lines of communication with your chosen integration provider to address any issues promptly.

Technical Support and Maintenance

Maintaining the performance and functionality of your ISV payment integrations requires ongoing technical support and maintenance. Challenges may arise in the form of software updates, bug fixes, or general system maintenance. Choosing an integration provider that offers reliable technical support and proactive maintenance ensures that any issues are addressed promptly, minimizing disruptions to your business operations.

Benefits of ISV Payment Integrations for Business Growth

ISV payment integrations offer a wide range of benefits that contribute to the overall growth and success of your business.

Expanded Payment Options

By integrating multiple payment gateways and e-commerce platforms, you can offer your customers a variety of payment options. This flexibility enhances their purchasing experience, increases customer satisfaction, and ultimately leads to repeat business.

Improved Transaction Security

With the increasing prevalence of online fraud and data breaches, ensuring transaction security is paramount. ISV payment integrations provide robust security features, including encryption and secure data transmission, protecting your business and customers from potential threats.

Accurate and Real-Time Reporting

ISV payment integrations automate the process of reporting and provide accurate, real-time insights into your financial data. This transparency allows you to make informed decisions, identify trends, track revenue, and monitor overall business performance.

Efficient Inventory Management

Integrating ISV payment solutions with inventory management systems enables you to streamline your stock control processes. The integration allows for real-time updates on inventory levels, automated restocking alerts, and accurate tracking of sales and returns. This automation minimizes manual errors, prevents stockouts, and ensures that your inventory is always optimized.

Key Considerations for ISV Payment Integration Partnerships

When selecting a partner for ISV payment integrations, several key considerations can ensure a successful and long-lasting partnership.

Vendor Reputation and Reliability

Choose an integration provider with a solid reputation and a track record of reliability. Look for providers with established industry experience, positive user reviews, and a commitment to customer satisfaction. Verifying their reputation and reliability will give you confidence in their ability to deliver a stable and dependable integration solution.

Integration Support and Customization

Ensure that the chosen integration provider offers comprehensive integration support, including technical assistance, documentation, and training resources. Additionally, consider their ability to customize the integration to match your specific business needs. A provider that understands your unique requirements and offers customization options will help you maximize the value of the integration.

Client References and Case Studies

Request client references and case studies from the integration provider to gain insights into their past projects and successes. Contact other businesses that have integrated with the provider to learn about their experiences. This due diligence will provide valuable firsthand information and help you gauge the provider’s ability to meet your business needs.

Long-Term Partnership Potential

As ISV payment integrations are a long-term investment, it is essential to consider the potential for a long-term partnership with the chosen integration provider. Assess their roadmap for future developments, their commitment to innovation, and their ability to scale and adapt to your business’s growth.

Case Studies of Successful ISV Payment Integrations

To illustrate the benefits and success of ISV payment integrations, here are some case studies showcasing businesses that have experienced notable improvements after implementing integrated payment solutions.

Company A: Increased Online Sales by 30%

Company A, an e-commerce retailer, integrated a leading payment gateway into their website. This integration allowed them to offer a seamless and secure online purchasing experience to their customers. As a result, Company A reported a significant increase in online sales, with a 30% growth in revenue. The integration also provided them with valuable customer insights through real-time reporting, enabling them to optimize their marketing strategies and drive further growth.

Company B: Streamlined In-Store Payments and Inventory Management

Company B, a retail chain with multiple physical stores, integrated a POS system into their existing software. This integration streamlined their in-store payment processes, allowing for faster and more efficient transactions. Furthermore, the integration synchronized their inventory management systems, enabling real-time updates on stock levels and preventing stockouts. Company B reported a substantial reduction in payment processing times and inventory management errors, leading to improved customer satisfaction and increased sales.

Company C: Enhanced Customer Engagement and Loyalty

Company C, a subscription-based service provider, integrated recurring payment functionality into their software. This integration simplified their billing processes and allowed for automated recurring payments. As a result, Company C experienced improved customer engagement and loyalty, as customers found it convenient to continue using their services without manually making payments each time. Additionally, the integration provided detailed reports on customer payment behavior, enabling Company C to offer personalized promotions and discounts, further enhancing customer satisfaction and retention.

Company D: Expanded International Payment Capabilities

Company D, an e-commerce business expanding into international markets, integrated a payment gateway that supported international transactions and multiple currencies. This integration enabled them to accept payments from customers across borders and offer localized pricing. By expanding their payment capabilities, Company D experienced a significant increase in international sales and expanded their customer base. The integration also eliminated the need for additional manual processes, saving time and resources, and ensuring a smooth payment experience for their global customers.

Future Trends and Innovations in ISV Payment Integrations

The field of ISV payment integrations continues to evolve, with several emerging trends and innovations shaping the industry’s future.

Mobile Payment Integration

With the increasing prevalence of smartphones and mobile apps, mobile payment integration is gaining immense popularity. Integrating mobile payment solutions into your software allows customers to make payments using their smartphones, further enhancing convenience and accessibility.

Artificial Intelligence and Machine Learning

The integration of artificial intelligence and machine learning technologies into ISV payment solutions enables businesses to analyze vast amounts of payment data. This analysis can help identify patterns, detect fraudulent activities, and provide personalized recommendations to customers.

Blockchain Technology

Blockchain technology is revolutionizing the way transactions are processed and secured. Integrating blockchain-based payment solutions offers enhanced security, transparency, and traceability, reducing the risk of fraud and ensuring the integrity of financial transactions.

Data Analytics and Personalization

ISV payment integrations are increasingly leveraging data analytics to provide personalized experiences to customers. By analyzing payment data, businesses can gain insights into customer preferences and shopping behaviors, enabling them to offer tailored promotions and recommendations.

Conclusion

In conclusion, ISV payment integrations are crucial for businesses looking to enhance efficiency, streamline operations, and provide an outstanding customer experience. By integrating payment gateways, POS systems, accounting software, and e-commerce platforms into their software, businesses can automate payment processes, expand payment options, improve transaction security, and gain real-time insights into financial data. However, selecting the right integration requires careful consideration of factors such as compatibility, security, scalability, and cost. By following the steps outlined in this article and partnering with reputable integration providers, businesses can successfully implement ISV payment integrations and unlock growth opportunities. Furthermore, the future of ISV payment integrations holds exciting trends such as mobile payment integration, artificial intelligence, blockchain technology, and data analytics, ensuring continued innovation and advancement in this field. As the business landscape continues to evolve, businesses that embrace ISV payment integrations will be at the forefront of delivering exceptional customer experiences and achieving sustainable growth.