In the ever-evolving world of business, accepting credit card payments has become a necessity. But with so many merchant credit card processing solutions available, how do you choose the best one for your business? Detroit Retail Merchants understands the importance of finding the right program that suits your needs. From ensuring secure transactions to competitive rates, this article provides valuable insights and practical tips to help you navigate through the sea of options and select the merchant credit card processing solution that is perfect for your business.

Understand Your Business Needs and Goals

When choosing a merchant credit card processing solution for your business, it is important to first clearly define your business requirements. Consider the specific needs of your industry and your customer base. For example, if you run a retail store, you may need a point-of-sale (POS) system that can process payments quickly and efficiently. On the other hand, if you operate an online business, you will need an online payment gateway that integrates smoothly with your website.

In addition to understanding your current needs, it is also crucial to identify your long-term goals and growth plans. You want to choose a credit card processing solution that can scale with your business and accommodate future expansion. Consider whether the solution offers features and services that can support your future goals, such as the ability to handle growing transaction volumes or support international transactions and currencies.

Evaluate Different Types of Merchant Credit Card Processing Solutions

There are various types of merchant credit card processing solutions available in the market. It is important to evaluate each type and determine which one is the best fit for your business.

Traditional merchant accounts are offered by banks or financial institutions and provide a direct processing solution. This type of account is typically suited for businesses with high transaction volumes and stable revenue streams.

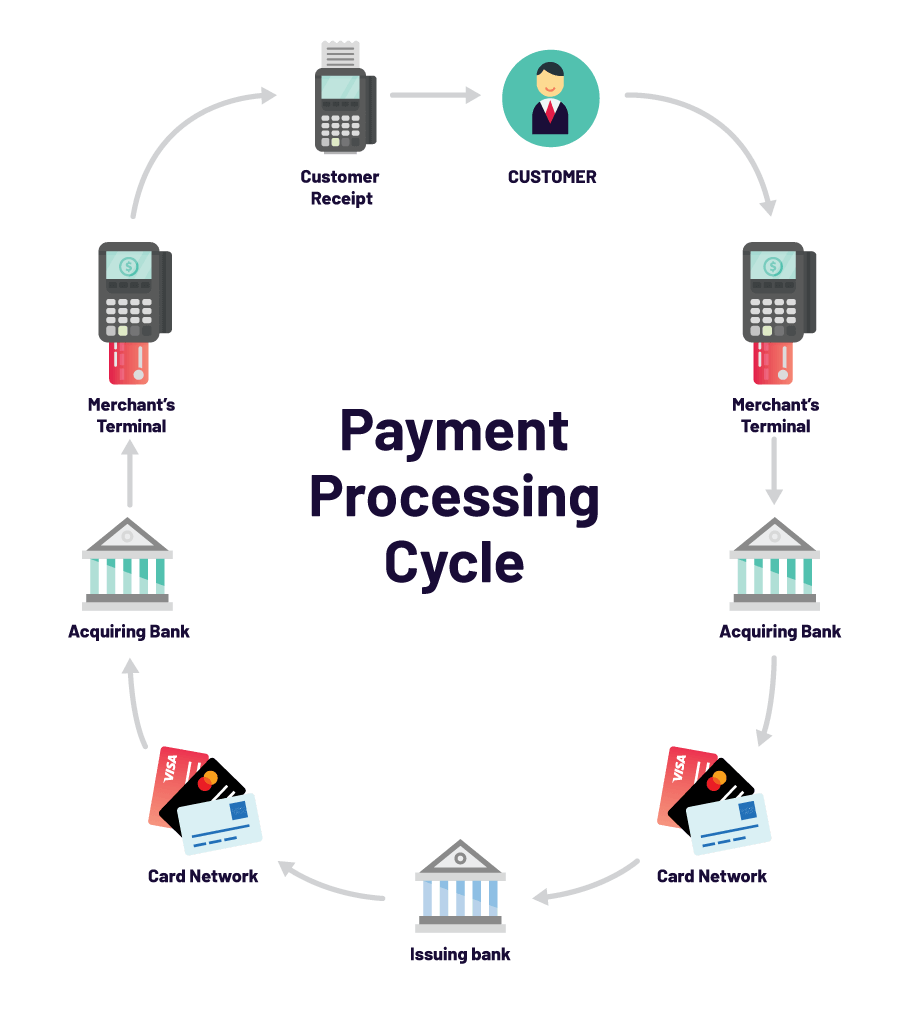

Payment Service Providers (PSPs) act as a middleman between your business and the acquiring bank, simplifying the process of accepting credit card payments. PSPs offer a range of services and can be a good option for small businesses or those with limited resources.

Third-Party Processors are independent companies that handle credit card processing on behalf of your business. They often offer competitive rates and can be a convenient option for businesses that do not have a dedicated payment processing infrastructure.

Mobile payment solutions allow businesses to accept credit card payments using smartphones or tablets. This type of solution is ideal if you frequently make sales on the go or at trade shows.

Online payment gateways are essential for e-commerce businesses. They facilitate the secure transfer of payment data between your website and the acquiring bank, ensuring a smooth and secure online transaction process.

Determine the Pricing Structure and Fees

Understanding the pricing structure and fees associated with merchant credit card processing solutions is essential. Different providers may offer various pricing models, so it is important to consider which one aligns with your business needs.

Interchange Plus Pricing is a transparent pricing model that separates the interchange fees set by card networks from the processor’s markup. This model offers businesses more visibility into the cost of each transaction.

Tiered Pricing groups transactions into different tiers based on their risk level, which can lead to higher fees for certain types of transactions. While this model may be simpler to understand, it may not be the most cost-effective option for all businesses.

Flat-Rate Pricing charges a fixed percentage for each transaction, regardless of the card type or risk level. This straightforward pricing model can be advantageous for businesses with low transaction volumes or those that process a high volume of low-value transactions.

In addition to transaction-based fees, it is important to consider other potential costs, such as monthly fees, chargeback fees, and early termination fees. These fees can vary significantly among providers, so it is important to carefully review and compare them before making a decision.

Consider Security and Fraud Protection

Security and fraud protection should be top priorities when choosing a merchant credit card processing solution for your business. Protecting your customers’ payment information and preventing fraudulent transactions is crucial to maintaining trust and credibility.

Ensure that the solution you choose complies with industry standards such as EMV chip card compliance and PCI DSS compliance. EMV chip cards provide an added layer of security by encrypting transaction data, making it harder for fraudsters to clone or counterfeit cards.

Tokenization is another important security feature to look for. It replaces sensitive card data with a unique identifier, or token, which is stored securely by the payment processor. This reduces the risk of data breaches and helps protect your customers’ payment information.

Fraud detection and prevention tools are also essential for protecting your business and customers. Look for a solution that offers robust fraud monitoring and prevention features, such as real-time transaction monitoring and velocity checks.

End-to-end encryption is another important security measure to consider. It ensures that payment data is securely transmitted from the point of sale to the payment processor, protecting it from interception or tampering.

Assess Integration and Compatibility

Before choosing a merchant credit card processing solution, it is important to assess its integration and compatibility with your existing systems and software. Depending on the nature of your business, you may need the solution to seamlessly integrate with various platforms.

For businesses with physical locations, compatibility with point-of-sale (POS) systems is crucial. Make sure the credit card processing solution you choose can integrate smoothly with your existing POS system or consider upgrading to a new system that is compatible with the chosen solution.

If you run an e-commerce business, you will need to ensure that the credit card processing solution integrates seamlessly with your chosen e-commerce platform. This allows for a smooth checkout process for your customers and streamlined order management for your business.

Mobile apps are becoming increasingly popular for businesses of all sizes. If your business has a mobile app, it is important to choose a credit card processing solution that can integrate with it seamlessly. This allows your customers to make purchases within the app using their credit cards.

If you use accounting software or a customer relationship management (CRM) system, consider whether the credit card processing solution can integrate with these platforms. This integration can streamline your business operations and improve efficiency.

Examine Customer Support and Service

When you encounter issues or have questions about your credit card processing solution, having reliable customer support is crucial. Look for a provider that offers 24/7 technical support, ensuring that assistance is available whenever you need it.

Availability of multichannel support is another important factor to consider. Having multiple ways to contact customer support, such as phone, email, or live chat, ensures that you can reach them using the method that is most convenient for you.

Prompt response time is essential, especially when dealing with payment-related issues. Choose a provider that is known for its quick response times and efficient resolution of customer inquiries.

Access to merchant tools and resources can also enhance your experience with a credit card processing solution. Look for a provider that offers a robust online portal or dashboard where you can access transaction reports, manage disputes, and track your business’s performance.

Research the Reputation and Reliability of Providers

Before making a decision, it is important to research the reputation and reliability of the credit card processing solution providers you are considering. Reading customer reviews and testimonials can give you valuable insights into the experiences of other businesses.

Checking the provider’s industry experience is also important. Look for providers that have a proven track record of serving businesses in your industry. They will likely have a better understanding of your specific needs and challenges.

Ensure that the provider is financially stable and reliable. You want to work with a company that can support your business for the long term and has a solid reputation for reliability and security.

It is also important to investigate any past legal or ethical issues the provider may have had. Look for any publicized lawsuits, regulatory violations, or ethical controversies. A provider with a clean track record is more likely to be trustworthy and reliable.

Consider Scalability and Flexibility

As a business owner, you want a credit card processing solution that can grow and scale with your business. Consider the solution’s ability to handle growing transaction volumes. Can it efficiently process a higher volume of transactions without experiencing performance issues?

Compatibility with different payment types is another important consideration. Ensure that the solution supports various types of payment methods, such as credit cards, debit cards, and mobile payments. This allows you to cater to a wider range of customer preferences.

If you are planning to expand your business internationally, it is important to choose a credit card processing solution that supports international transactions and currencies. Look for a provider that has a global presence and can offer localized payment options for different regions.

Compare Pricing and Contract Terms

To make an informed decision, it is important to compare pricing and contract terms from multiple credit card processing solution providers. Request quotes from different providers and carefully review the pricing structures and associated fees.

Compare the pricing models and consider which one aligns with your business needs and transaction volumes. Take into account not just the per-transaction fees, but also the monthly fees, chargeback fees, and early termination fees.

Review the contract terms and conditions to ensure that they are fair and reasonable. Beware of any hidden fees or long-term contracts that can be difficult to terminate if you are dissatisfied with the service.

Finalize Your Decision

After considering all the factors and completing your research, it is time to finalize your decision. Remember to prioritize your requirements and choose a credit card processing solution that meets your business needs and goals.

Once you have made your choice, it may be worth negotiating the terms and conditions with the chosen provider. If there are particular features or services that are important to your business, discuss them with the provider and see if they are willing to accommodate your needs.

Finally, once the decision has been made and the terms have been agreed upon, you can begin the implementation process. Work closely with the provider to ensure a smooth transition and test the solution thoroughly before fully integrating it into your business operations.

By following these steps and conducting thorough research, you can choose the best merchant credit card processing solution for your business. A well-chosen solution can streamline your payment processes, enhance security, and support your business’s growth and success.