If you own or operate a subscription-based business, you know how important it is to have a smooth and streamlined system for handling recurring payments. In this article, we will explore various tools and solutions that can simplify the process of recurring billing, making it easier for both you and your customers. These tools range from automated payment processors to customizable billing software, all designed to help optimize your subscription-based business and enhance customer satisfaction. So let’s dive in and discover the best tools for streamlining payments in your subscription-based business!

Introduction

Managing recurring billing can be a complex and time-consuming process for subscription-based businesses. From invoicing and payment collection to customer communication and reporting, there are numerous challenges to overcome. However, by utilizing the right tools and strategies, businesses can simplify their recurring billing processes, improve cash flow management, and enhance the overall customer experience. In this article, we will explore the importance of simplifying recurring billing and discuss various tools and techniques that can help streamline payment processes for subscription-based businesses.

1. Importance of Simplifying Recurring Billing

1.1 Reducing Administrative Burden

One of the key advantages of simplifying recurring billing is the reduction of administrative burden. Manual invoicing and collections can be time-consuming and prone to errors. By automating these processes, businesses can save valuable time and resources, allowing their staff to focus on more important tasks.

1.2 Improving Cash Flow Management

Another significant benefit of streamlining recurring billing is improved cash flow management. Inconsistent payment schedules can lead to cash flow gaps, making it challenging for businesses to meet their financial obligations. By implementing automated billing processes, businesses can ensure that payments are collected on time, minimizing cash flow disruptions.

1.3 Enhancing Customer Experience

Simplified recurring billing can also greatly enhance the customer experience. Customers appreciate convenience and reliability when it comes to payment processes. With streamlined payment options and personalized billing, businesses can provide a seamless customer experience, fostering customer loyalty and satisfaction.

2. Common Challenges Faced by Subscription-Based Businesses

Subscription-based businesses face a unique set of challenges when it comes to recurring billing. Let’s explore some of these challenges and how they can be addressed.

2.1 Inconsistent Payment Schedules

Inconsistent payment schedules pose a challenge for subscription-based businesses, as it becomes difficult to predict and manage cash flow effectively. Implementing tools that automate payment reminders and offer flexible billing options can help mitigate this challenge.

2.2 Manual Invoicing and Collections

Manually generating invoices and managing collections can be time-consuming and prone to errors. It also delays the payment process, affecting cash flow. By using subscription billing software, businesses can automate invoicing and collections, reducing errors and expediting payment processes.

2.3 Managing Failed Payments

Failed payments can create disruptions in cash flow and require manual intervention to resolve. With the right tools, such as automated payment retries and intelligent payment routing, businesses can automate the management of failed payments, minimizing disruptions and improving efficiency.

2.4 Customer Communication and Retention

Effective communication with customers is crucial for retention and satisfaction. Subscription-based businesses need to keep their customers informed about billing updates, upcoming payments, and any changes to their subscription plans. Implementing customer portals and self-service options can empower customers to manage their billing preferences and stay engaged with the business.

3. Tools to Automate Recurring Billing Processes

To simplify recurring billing, businesses can leverage various tools and software solutions. Let’s explore some of these tools and their benefits.

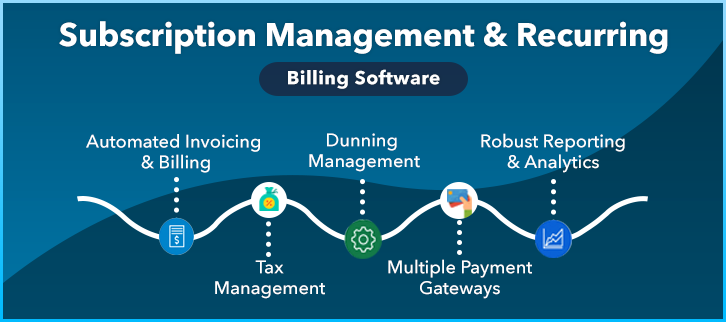

3.1 Subscription Billing Software

Subscription billing software automates the entire billing workflow, from generating invoices to collecting payments. These platforms offer features like recurring billing, proration, and invoice customization, making it easier for businesses to manage their subscriptions and streamline payment processes.

3.2 Payment Gateway Integrations

Integrating payment gateways with subscription billing software enables businesses to securely collect payments from customers. With a wide range of payment options, such as credit cards, e-checks, and digital wallets, businesses can offer their customers flexibility and convenience.

3.3 Customer Portal and Self-Service Options

By providing customers with a dedicated portal and self-service options, businesses can empower customers to manage their billing preferences and access their payment history. This not only enhances the customer experience but also reduces customer support inquiries.

3.4 Dunning Management Systems

Dunning management systems automate the process of managing failed payments. These systems send automated payment reminders, initiate payment retries, and even facilitate the process of updating payment information, ensuring a seamless billing experience for customers.

3.5 API and Webhooks for Automation

APIs and webhooks allow businesses to integrate their billing systems with other applications and automate various processes. They enable real-time data synchronization, trigger events based on specific conditions, and automate tasks such as subscription upgrades or downgrades.

4. Streamlining Payment Collection

Streamlining payment collection is crucial for subscription-based businesses to ensure timely and efficient revenue generation. Here are some tools and strategies to achieve this goal.

4.1 Online Payment Gateways

Online payment gateways enable businesses to securely collect payments through various channels such as websites or mobile applications. These gateways offer a wide range of payment options, making it easy for customers to choose their preferred method of payment.

4.2 ACH and Direct Debit Solutions

ACH (Automated Clearing House) and direct debit solutions allow businesses to collect payments directly from customers’ bank accounts. These solutions are particularly useful for recurring payments, as they eliminate the need for manual credit card updates and reduce processing fees.

4.3 Mobile Payment Options

With the increasing use of smartphones, offering mobile payment options has become essential for businesses. Integrating mobile payment solutions into their billing processes allows customers to make payments conveniently, irrespective of their location.

4.4 Electronic Invoicing and Automated Reminders

By digitizing the invoicing process and automating reminders, businesses can expedite payment collection. Electronic invoicing eliminates delays associated with physical mail and enables customers to make payments with just a few clicks.

5. Enhancing Customer Experience

A positive customer experience is crucial for the success of subscription-based businesses. Here are some strategies to enhance the customer experience through simplified recurring billing.

5.1 Simplified Checkout Process

A complex and lengthy checkout process can discourage customers from completing their purchase. By simplifying the checkout process and offering guest checkout options, businesses can minimize friction and improve conversion rates.

5.2 Multi-channel Payment Options

Customers have diverse preferences when it comes to payment methods. Offering multiple payment options, such as credit cards, digital wallets, and bank transfers, allows customers to choose the method that is most convenient for them.

5.3 Personalized Billing and Pricing

Personalized billing and pricing options allow businesses to tailor their offerings to individual customers. This creates a sense of exclusivity and demonstrates that the business values its customers, ultimately enhancing the overall customer experience.

5.4 Flexible Billing Options

Flexibility in billing options can greatly enhance the customer experience. Offering options such as monthly, yearly, or customized subscription plans empowers customers to choose the payment frequency and duration that best suits their needs.

6. Managing Failed Payments

Failed payments are a common challenge for subscription-based businesses. Here are some strategies to efficiently manage and recover failed payments.

6.1 Automated Payment Retries

Implementing automated payment retries can greatly improve the collection of failed payments. By setting up multiple retry attempts at specific intervals, businesses increase the chances of successfully collecting the outstanding amount.

6.2 Intelligent Payment Routing

Intelligent payment routing involves automatically selecting the best payment gateway or processor for each transaction. This helps optimize payment success rates and minimize payment failures.

6.3 Customer Communication on Failed Payments

Effective communication with customers is vital when it comes to failed payments. By sending proactive notifications and offering easy ways to update payment information, businesses can reduce the number of failed payments and maintain a positive customer relationship.

7. Reporting and Analytics

To effectively manage recurring billing, businesses need accurate and timely data. Reporting and analytics tools provide valuable insights that can help businesses track payments, forecast revenue, and analyze customer churn. Let’s explore some key features of these tools.

7.1 Real-time Payment Tracking

Real-time payment tracking allows businesses to monitor the status of payments in real-time. This helps identify any delays or issues and allows for proactive actions to resolve them.

7.2 Revenue Forecasting

By analyzing historical payment data and trends, businesses can forecast future revenue more accurately. Revenue forecasting tools provide valuable insights that enable businesses to make informed decisions and set realistic growth targets.

7.3 Churn Analysis

Churn analysis tools help businesses identify and understand the reasons for customer churn. By analyzing patterns and behaviors of customers who cancel their subscriptions, businesses can take proactive measures to improve customer retention and reduce churn.

8. Compliance and Security Considerations

When it comes to managing recurring billing, compliance and security are of utmost importance. Businesses must ensure that they adhere to industry regulations and protect customer data. Let’s explore some key considerations in this regard.

8.1 PCI-DSS Compliance

Payment Card Industry Data Security Standard (PCI-DSS) compliance is essential for businesses that handle credit card information. It ensures that businesses follow strict security protocols to protect sensitive payment data from breaches or unauthorized access.

8.2 Data Encryption and Tokenization

Encrypting and tokenizing customer data adds an extra layer of security to the billing process. By encrypting sensitive information and replacing it with unique tokens, businesses can reduce the risk of data breaches.

8.3 Fraud Detection and Prevention

Implementing robust fraud detection and prevention measures is crucial for protecting both the business and its customers. By using AI-powered algorithms and machine learning, businesses can identify suspicious activities and prevent fraudulent transactions.

Conclusion

Simplifying recurring billing processes is essential for subscription-based businesses to reduce administrative burden, improve cash flow management, and enhance the overall customer experience. By leveraging tools and strategies such as subscription billing software, payment gateway integrations, customer portals, and automated reminders, businesses can streamline payment collection, manage failed payments effectively, and provide an exceptional customer experience. Additionally, reporting and analytics tools enable businesses to track payments, forecast revenue, and analyze customer churn, while compliance and security considerations ensure the protection of customer data. By embracing these tools and best practices, subscription-based businesses can optimize their recurring billing processes and lay a strong foundation for long-term success.