Unlocking The Power Of accepting credit card payments On PNC Bank is a video by Clover POS that delves into the benefits of accepting credit card payments through PNC Bank. By accepting credit cards, your business can greatly benefit from improved customer convenience and increased revenue. With PNC Bank’s secure and reliable payment processing solutions, you’ll have access to real-time transaction data and reporting, allowing you to better understand your business’s financial performance. Additionally, PNC Bank offers industry-leading security measures to protect your business and customers from fraud and data breaches, with 24/7 monitoring and dedicated support to quickly resolve any payment-related issues.

Accepting credit card payments can open up a world of opportunities for your business, attracting new customers and providing a seamless checkout experience. PNC Bank‘s payment processing solutions enable you to easily manage your transactions, track payments, and analyze sales data with their user-friendly interface and robust features. By streamlining your business operations and reducing the risk of errors or delays, you can access your revenue faster and manage your cash flow more effectively. To get started with accepting credit card payments on PNC Bank, simply set up a merchant account with their range of tailored services, including in-person, online, and mobile payment processing options.

Benefits of Accepting Credit Card Payments

Attracting new customers

Accepting credit card payments can greatly benefit your business by attracting new customers. Many consumers prefer to pay with credit cards, and by accepting this form of payment, you can cater to their preferences and increase the likelihood of attracting new customers. By expanding your payment options to include credit cards, you are making it easier for potential customers to make purchases from your business, which can lead to increased sales and customer loyalty.

Boosting sales

One of the major advantages of accepting credit card payments is the potential to boost your sales. When customers have the option to pay with a credit card, they may be more inclined to make larger purchases or buy additional items. This can lead to an increase in the average transaction value and ultimately result in higher sales for your business.

Providing a seamless checkout experience

Accepting credit card payments can also provide your customers with a seamless checkout experience. With the ability to conveniently pay using their credit cards, customers can avoid the hassle of carrying cash or writing checks. This not only improves customer satisfaction but also speeds up the transaction process, allowing your business to serve more customers efficiently.

Payment Processing Solutions with PNC Bank

Access to real-time transaction data

By choosing PNC Bank as your payment processing provider, you will have access to real-time transaction data. This means you can easily track and monitor the transactions happening in your business, helping you gain a better understanding of your sales patterns and customer behavior. With this valuable data, you can make more informed decisions about inventory management, marketing strategies, and overall business planning.

Insights into financial performance

PNC Bank’s payment processing solutions go beyond just transaction data. They also provide insights into your business’s financial performance. By accessing detailed reports and analytics, you can analyze trends, identify areas of improvement, and optimize your revenue streams. This information is vital for making sound financial decisions that can drive your business’s growth and success.

Streamlining operations and boosting revenue

PNC Bank’s payment processing solutions are designed to streamline your business operations and boost your revenue. By leveraging their reliable and secure payment processing platform, you can free up time and resources that would have otherwise been spent on manual payment handling. This allows you to focus on other important aspects of your business, such as customer service and product development. With streamlined operations, you can maximize efficiency and drive revenue growth.

Security Measures for Credit Card Payments

Industry-leading security measures

When it comes to processing credit card payments, security should always be a top priority. PNC Bank understands this and offers industry-leading security measures to protect your business and your customers. Their secure payment processing platform is built with advanced security features to ensure that all transactions are encrypted and protected from unauthorized access.

Fraud protection and data breach prevention

PNC Bank’s payment processing solutions include robust fraud protection measures to safeguard your business from fraudulent activities. Their systems actively monitor transactions for any signs of suspicious or fraudulent activity and take immediate action to mitigate risks. Additionally, PNC Bank implements rigorous data breach prevention protocols, keeping your customers’ sensitive information safe and secure.

Encryption and secure transmission of customer information

With PNC Bank’s payment processing solutions, you can rest assured knowing that your customers’ information is encrypted and transmitted securely. This means that their credit card details and personal data are protected throughout the entire payment process, reducing the risk of unauthorized access or identity theft. PNC Bank’s commitment to security ensures that your customers can trust your business with their sensitive information.

24/7 Monitoring and Support

Dedicated support for resolving payment-related issues

PNC Bank provides dedicated support to help you resolve any payment-related issues that may arise. Their team of experts is available to assist you with troubleshooting, answering questions, and resolving any technical or operational challenges. This ensures that your business can quickly address any issues and continue providing a seamless payment experience for your customers.

Availability of round-the-clock monitoring

In addition to dedicated support, PNC Bank offers 24/7 monitoring of your payment processing activities. This proactive monitoring helps identify and prevent potential issues before they escalate, ensuring uninterrupted service for your business. With round-the-clock monitoring, you can have peace of mind knowing that your payment operations are being closely monitored by professionals who are ready to handle any situation.

Streamlining Business Operations

Eliminating the need for manual payment handling

Accepting credit card payments through PNC Bank can streamline your business operations by eliminating the need for manual payment handling. With their payment processing solutions, transactions are processed electronically, reducing the reliance on cash or checks. This not only saves you time but also minimizes the risk of errors or discrepancies often associated with manual payment handling.

Reducing the risk of errors or delays

By automating your payment processes with PNC Bank, you can significantly reduce the risk of errors or delays. Manual payment handling is prone to human errors, such as incorrect calculations or misplaced checks. With PNC Bank’s payment processing solutions, you can rely on their robust systems to accurately process transactions and eliminate the chance of human error.

Fast and hassle-free settlement

PNC Bank’s payment processing solutions offer fast and hassle-free settlement, ensuring that funds from credit card transactions are deposited into your account quickly. This allows you to access your revenue faster and manage your cash flow more effectively. With efficient settlement processes, you can optimize your working capital and focus on growing your business.

Setting Up a Merchant Account with PNC Bank

Range of merchant services tailored to business needs

To start accepting credit card payments on PNC Bank, you’ll need to set up a merchant account. PNC Bank offers a range of merchant services tailored to meet the unique needs of your business. Whether you operate a retail store, an online business, or a mobile service, PNC Bank has the right payment processing solutions for you. Their offerings can be customized to fit your specific requirements, ensuring that you have the tools and features necessary to run your business smoothly.

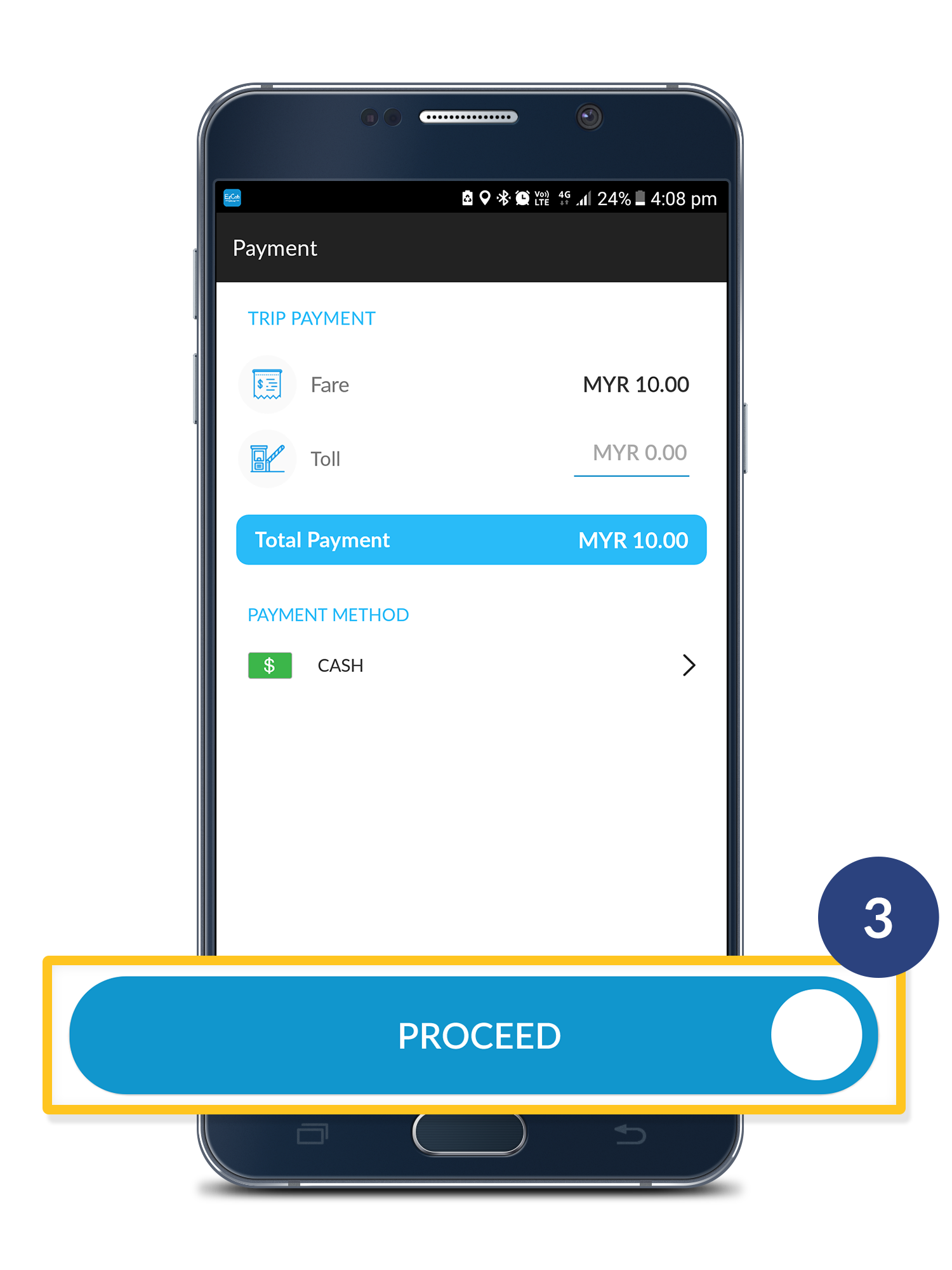

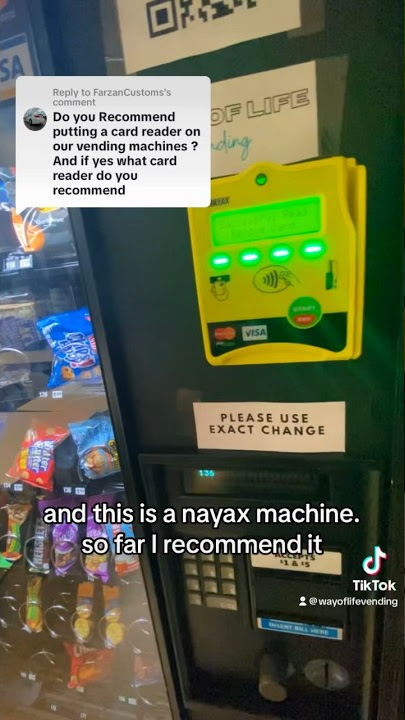

Options for in-person, online, and mobile payments

PNC Bank understands that businesses operate in different environments and cater to diverse customer demographics. That’s why they offer payment processing options for in-person, online, and mobile payments. Whether you have a physical store, an e-commerce website, or a mobile app, PNC Bank can provide you with the necessary tools to accept credit card payments seamlessly across multiple platforms. Their solutions are flexible and scalable, allowing your business to adapt and grow as needed.

User-friendly interface and robust features

PNC Bank’s payment processing solutions are designed with user-friendliness in mind. Their intuitive interface makes it easy for business owners and their staff to navigate and manage payments efficiently. Additionally, PNC Bank’s payment processing platform offers robust features such as transaction tracking, reporting, and analytics. These features provide valuable insights into your sales performance, customer behavior, and payment trends, helping you make data-driven decisions to optimize your business.

Conclusion

Accepting credit card payments on PNC Bank can unlock a world of opportunities for your business. By attracting new customers, boosting sales, and providing a seamless checkout experience, you can create a positive customer experience and drive revenue growth. With PNC Bank’s secure and reliable payment processing solutions, you can streamline your operations, gain access to real-time transaction data, and ensure the security of your customers’ sensitive information. Additionally, their 24/7 monitoring and dedicated support further enhance the payment experience for both you and your customers. Set up a merchant account with PNC Bank today and experience the benefits of accepting credit card payments for your business.

START ORDER BOOKING HERE – https://bravooffer.com/cloverposstore

In this video, we will explore the power of accepting credit card payments on PNC Bank. Accepting credit cards can greatly benefit your business and improve customer convenience. With PNC Bank, you’ll have access to secure and reliable payment processing solutions that can help streamline your operations and boost your revenue.

Accepting credit card payments can open up a world of opportunities for your business. It allows you to conveniently pay using your credit cards, which is often your preferred method of payment. By accepting credit cards, you can attract new customers, boost sales, and provide a seamless checkout experience. With PNC Bank’s payment processing solutions, you can gain access to real-time transaction data and reporting, making it easier for you to understand your business’s financial performance.

Security is a top priority when it comes to processing credit card payments. PNC Bank offers industry-leading security measures to protect your business and your customers from fraud and data breaches. With PNC Bank’s payment processing solutions, you can ensure that your sensitive information is encrypted and transmitted securely. Additionally, PNC Bank provides 24/7 monitoring and dedicated support to help you resolve any payment-related issues quickly and efficiently.

Keywords: accepting credit card payments, PNC Bank, payment processing solutions, customer convenience, boost revenue, attract customers, seamless checkout experience, real-time transaction data, financial performance, security measures, fraud protection, data breaches, encrypted information, 24/7 monitoring, dedicated support